Home › Mandy Moore

Meet Our Mortgage Loan officer Mandy Moore

Whether you're a first-time homebuyer or looking to refinance, our team of experienced professionals is here to guide you through every step of the process.

Whether you're a first-time homebuyer or looking to refinance, our team of experienced professionals is here to guide you through every step of the process.

Personalized Client Experience

Mandy is known for delivering tailored financing strategies that reflect each client’s specific goals, needs, and timelines. Her ability to translate complex mortgage details into clear,

Consistent, Proactive Communication

Clients appreciate Mandy’s proactive updates and clear communication throughout the loan process. Her responsiveness and dedication to transparency help eliminate confusion and stress, ensuring smooth transactions from pre-approval to closing.

Grounded and Compassionate

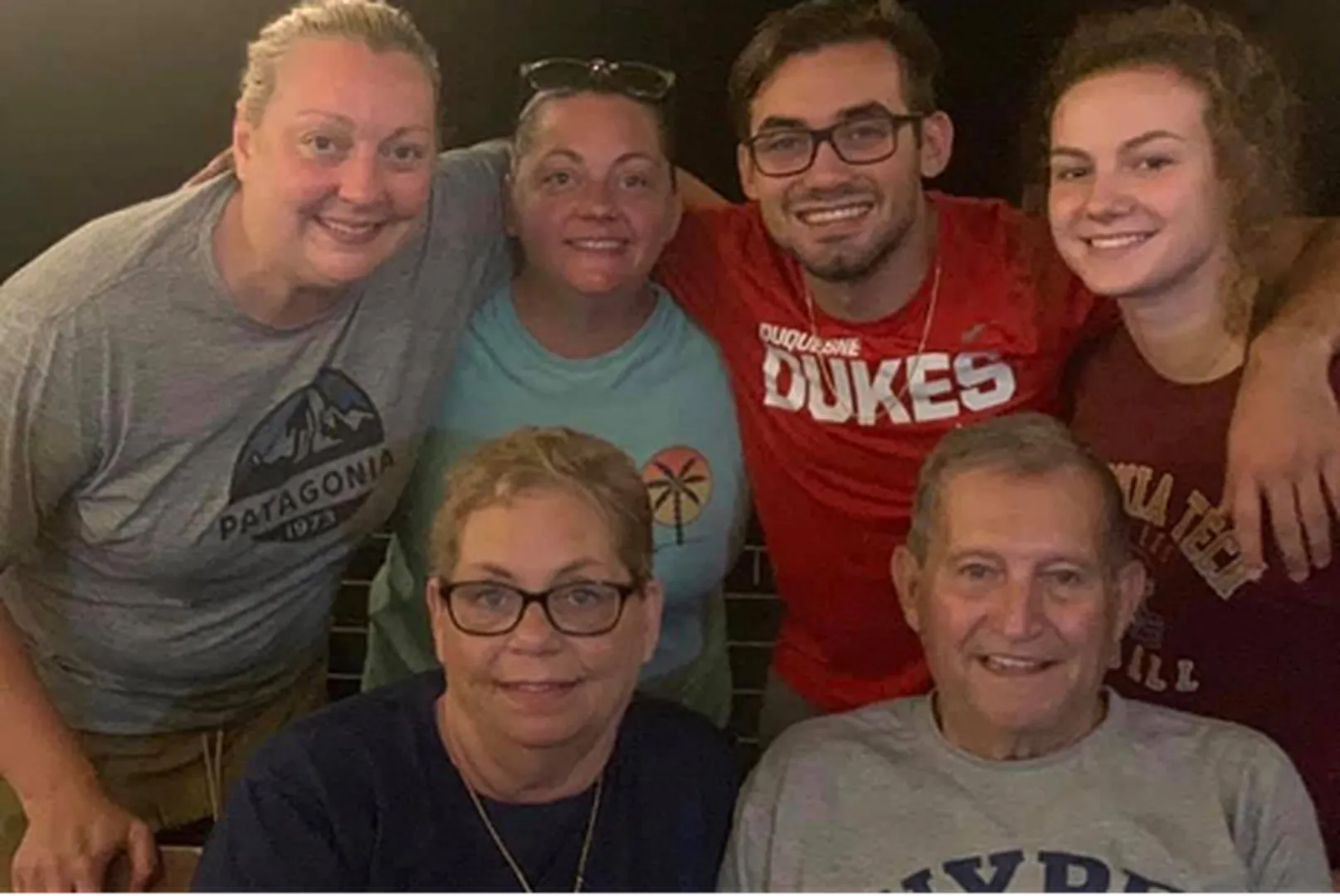

Outside of work, Mandy cherishes spending time with her loved ones, especially her family. This grounding in personal relationships brings warmth and empathy to her work, allowing her to connect with clients who are also making important decisions for their own families.

Trusted Advocate

Mandy’s reputation is built on a foundation of trust, follow-through, and client loyalty. Her career reflects a legacy of excellence in service and mentorship, helping hundreds of families and individuals feel empowered and confident throughout their home financing journey.

Adaptive and Strategic

Mandy has an in-depth understanding of loan programs and shifting market trends. Whether navigating conventional or government-backed loans, she adapts quickly to changes and uses her expertise to guide clients toward smart, strategic decisions that align with their long-term goals.

Resources

See how our clients achieved their homeownership goals with us.

We've based our home loan process on empathy for our home buyers and their agents.

Estimate your monthly payment and apply with confidence!

Discover loan options tailored to your needs and start your journey with confidence.

When buying a home, there are many documents you'll need to provide to your Mortgage Loan officer.

Testimonials

Hear From Our Clients

See how our clients achieved their homeownership goals with us.

Mandy was wonderful to work with. Very personable and knowledgeable. She was able to answer all of my questions and was able to tell me what to expect throughout the process. I would strongly recommend Mandy if you are in the market for a mortgager.

Mandy was referred to me and was great to work with. She made the process easy and was very thorough. I highly recommend using Mandy for your mortgage needs!!

Mandy Moore was exceptional. She was professional, efficient, and responsive. She answered questions very quickly and was always available for us. With her help and efficiency, we were able to close early.

Mortgage Loan officer

What Determines Your Credit Score?

Get Started

From Dreams to Keys

Whether you're a first-time homebuyer or looking to refinance, our team of experienced professionals is here to guide you through every step of the process.

Whether you're buying your first home or refinancing, Southern Trust Mortgage is here to guide you. With expert support and seamless loan solutions, we make homeownership simple and stress-free.

Southern Trust Mortgage LLC, NMLS #2921 ( www.nmlsconsumeraccess.org ) lends in the following states: District of Columbia – #MLB-2921 | Delaware –#036386 | Maryland | North Carolina – #205483 | Pennsylvania –#94064| South Carolina | Tennessee | West Virginia –#ML-34191 | Virginia – #MC7387 | Florida – MLD #2151; Southern Trust Mortgage, LLC d/b/a Southern Residential Lending in the following states: Georgia –#16579 | New Jersey – Licensed by the N.J. Department of Banking and Insurance. By refinancing a consumer’s existing loan, the consumer’s total finance charges may be higher over the life of the loan.